Table of Content

I am okay with the interest rates and the charges applied. My home loan is with KVB and I am not happy with the process because all the banks have a rate of 8.25% and this bank alone maintains a rate of 10.25%. The interest rate for housing loan top-up ranges between 8.05% p.a. Proof of Income (pay slips, current dated salary certificate, bank statement from the previous three months, or most recent ITR/ Form 16). As part of our efforts to make the end consumer services affordable and available at price points which are favourable to the customer, CreditMantri may receive fees / commissions from lenders. When applying for a home loan all the original documents pertaining to the property must be submitted to Karur Vysya Bank.

The EMI will also be high and hence you need to decide before hand how much loan amount you want, what interest rate you are comfortable paying and the tenure of the loan. The benchmark repo rate has hiked three times since then for a total of 50 basis points, reaching 5.90%, in an effort to lower domestic retail inflation, which has been beyond the RBI's maximum tolerated levels. The Reserve Bank of India started debating concepts for the forthcoming monetary policy on Monday.

Does the Home Loan interest rate vary immediately with any change in the MCLR?

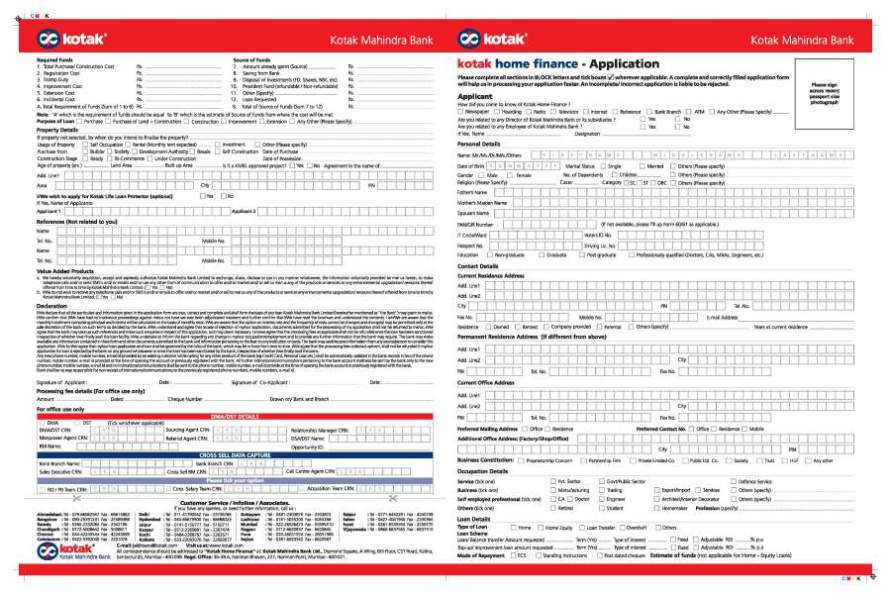

Suppose that you took a home loan for a period of 20 years, and if you opt for the Balance Transfer facility within the initial 10 years of your tenure, you can save a huge amount on both EMI and total interest outgo. After filling in all the details and attaching the documents you can submit the application. The loan may be provided to purchase unoccupied land and to begin and complete the building within 24 months of the date of loan approval. After subtracting the projected Loan payments, the applicant's take-home pay should be at least 25% of his or her gross income.

\nKarur Vysya Bank has a wide network of more than 600 branches pan India to welcome you with home loan application. You can apply online at their portal with the basic details evincing your expression of interest authorizing their representative to get in touch with you. It is their endeavor to make your application process hassle free in the following steps. \nThe loan amount designated for the home loan scheme is based on eligibility and no quantum is quoted. It is subject to meeting KVB norms and satisfying the needs through a supporting credit score from a reputed credit rating agency like CIBIL. This housing loan scheme caters the housing finance needs of NRI and PIO.

KVB Tax Saving Deposit

They can also call the Karur Vysya Bank home loan customer care to proceed with the application process. The Karur Vysya Bank home loan approval & verification process is simple and much quicker for existing Karur Vysya Bank customers. They can apply online and get pre-approved offers on home loans with attractive interest rates. The loan amount is directly credited to their account instantly. One of the first and foremost thing a home loan applicant must do is check their credit score. Any bank, when it gets a loan or credit card application will pull out the individuals credit score which is available with the credit bureaus operating in the country.

Shaktikanta Das, the governor of the RBI, will address the bimonthly monetary policy tomorrow, on December 7. Out of above 2 options, first option is more beneficial for the borrower as he pay less interest to the bank as the pay off home loan will be faster. The applicant's age must be in the range of 18 years and 70 years at the time of loan maturity. A GST rate of 18% will be applicable on banking services and products from 01 July, 2017.

Who is Eligible for the Karur Vysya Bank Home Loan?

Housing.com can be your one stop shop for home loan products. In spite of all the advantages, Karur Vysya Bank does not provide for any Premier Services for HNWIs. The other reason for the NRI to go in for home ownership is to provide for their aging parents or keeping the property for use in their twilight years after retirement.

As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings. \nA person in this class can have multiple benefits for KVB in the credit portfolio. This twofold benefit is enough for a high-net-worth individual to seek their home loan. Karur Vysya bank home advance financing cost is impacted by an assortment of variables; including advance amount, your net pay, your reimbursement history, and inward Karur Vysya bank advance evaluation parameters. For Karur Vysya bank current home loan financing cost, it is smarter to contact the bank straightforwardly. Calculating equated monthly instalment for Karur Vysya Bank Home Loan is extremely easy and instant with MyMoneyMantra's online EMI Calculator.

Renovation of existing houses or flats owned. Find Karur Vysya Bank Home loan purpose, Eligibility, Margin, Repayment of Home Loan ,Security, Document Required for Home Loan from below.

Not only this, with minimal fee and charges along and easy documentation, this lender makes sure that all your needs can easily be fulfilled without any hassle. This is the reason that this bank has created its own niche in the industry and has become the favorite of many when it comes to availing the home loan. In case you are interested to know more about Karur Vysya Bank Home Loan, this page is worth reading for you. It was very easy for me to avail a personal loan from KVB in the month of Jan'2014 because of my salary account.

Karur Vysya Bank is a private-area Indian bank, headquartered in Karur in Tamil Nadu. The bank likewise offers Internet Banking and Mobile Banking offices to its clients. The bank that conveys with it a tradition of 96 years but then is youthful to adjust it with the changing situation in the banking industry. KVB offers a few store and loan items, carefully fit to oblige the particular needs of clients. The net take-home pay should be at least 25% of gross pay after deducting the equated monthly instalment of the proposed housing loan. The primary security is the equitable mortgage of the property constructed or acquired out of the home loan.

Karur Vysya Bank adopts the daily reducing balance method for calculating Home Loan interest. Agriculturists have the option to repay the Home Loan in EQI or EHYI (equated half-yearly instalments). It is because farmers do not have a regular monthly income. Magicbricks is a full stack service provider for all real estate needs, with 15+ services including home loans, pay rent, packers and movers, legal assistance, property valuation, and expert advice.

No comments:

Post a Comment